APIs

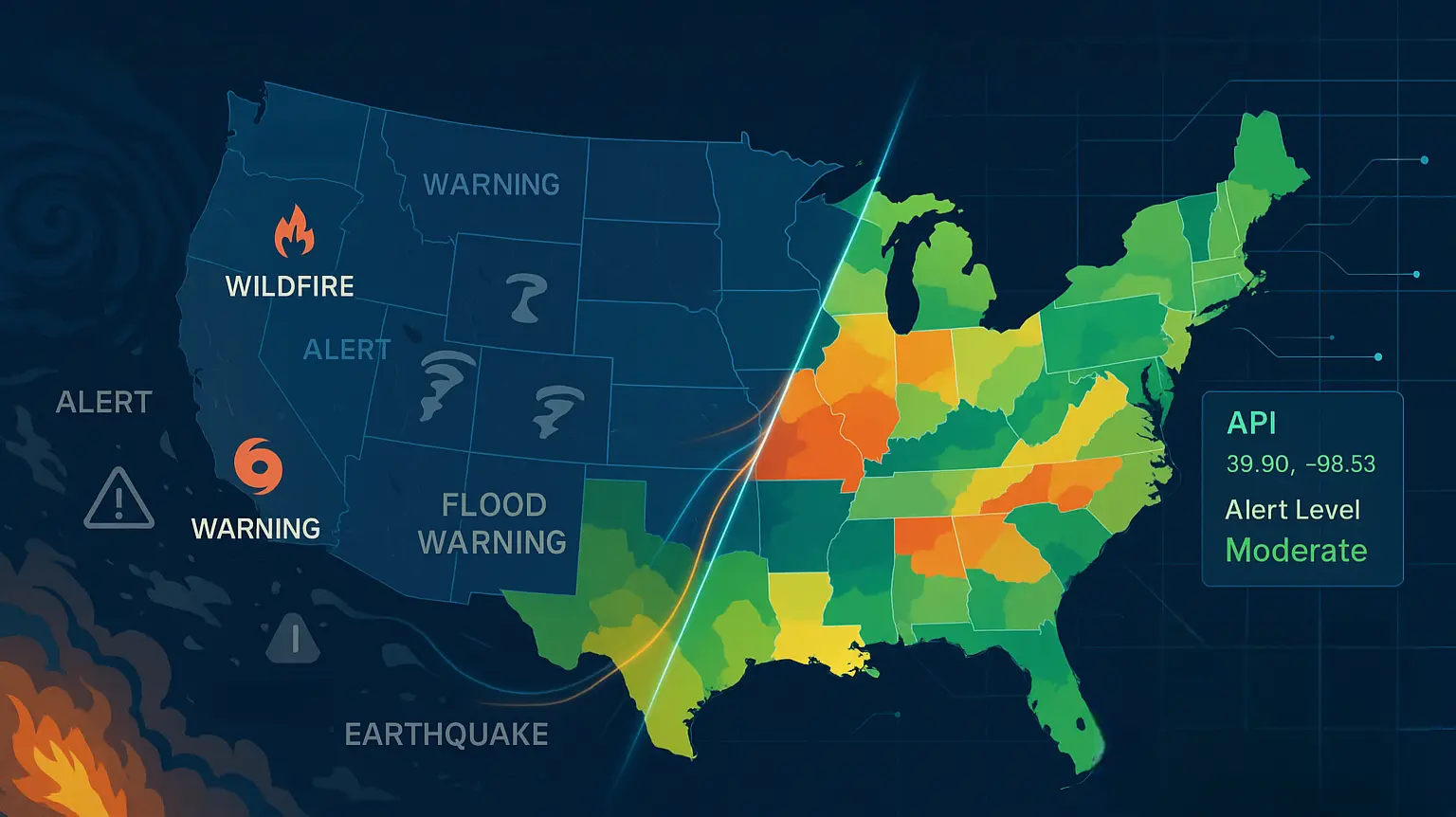

Reliable and Ready-To-Integrate Climate and Environmental APIs for Your Company’s Use Case

Industries

See How Other Industries are Using Ambee’s Data to Build their Products

Products

Ambee’s Suite of Products Powered by Cutting-Edge Proprietary Technology

Resources

Learn About Ambee’s Partnerships. Get Insights on Endless Use Cases. Explore More Informative Topics by Industry Experts.

Company

Learn about Ambee’s story and understand what it means to be a part of a purpose-driven workplace